Call Experts

+91 93631 75000

Code on Wages

-

The Minimum Wages Act, 1948

-

The Payment of Wages Act, 1936

-

The Payment of Bonus Act, 1965

-

The Equal Remuneration Act, 1976

}

Code on Wages 2019

Existing Legislation

New Legislation

Key Changes

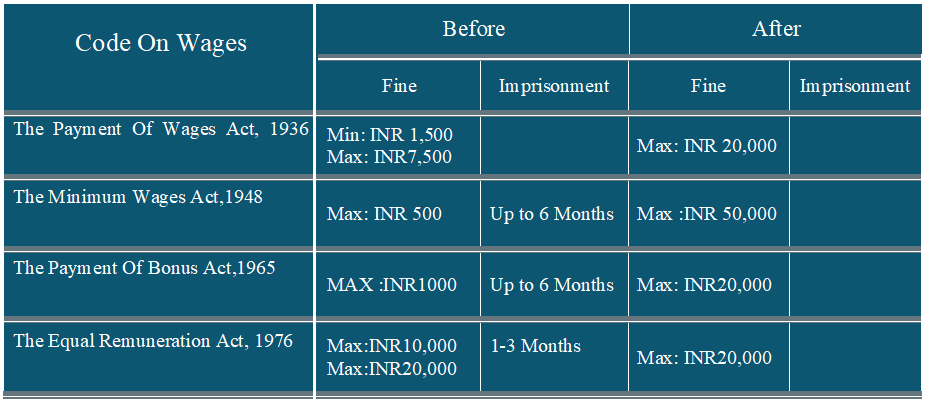

Non-Compliance Consequences Code On Wages,2019

-

Sec 2(g) defines ‘contract labour’ ( specifically includes inter-state migrant workmen and excludes the persons who are regularly employed )

-

Common definition for ‘wages’ for all the four existing laws [Sec 2(y)]

-

Certain allowances, excluded for Minimum Wages and Bonus but included for Payment of Wages and Equal Remuneration (Convey, HRA, Remuneration under Settlement & Award and OT)

-

A cap – 50 % - fixed for ‘excluded components’

-

HRA – No more part of minimum wages

-

No employer shall pay to any employee wages less than the minimum rates of wages notified by the appropriate Government ( Sec 5 )

-

The Central Government will fix the floor wages ( Sec 9 )

-

Rate of minimum wages fixed by the appropriate Government shall not be less than the floor wage

-

-

National floor wages shall be revised every 5 years [Rule 11 (4)]

-

Payment of Wages Act – Ceiling of Rs 24000/- removed now – the Act applies to all

-

In case of separation, including resignation, the settlement is to be made within the next two working days

-

Payment of Bonus chapter shall apply to the establishments in which 20 or more persons are or were employed on any day during an accounting year ( Sec 41(2) )

-

The Code is silent about the applicability if the threshold limit falls below subsequently

-

Wages ceiling for eligibility for Bonus : To be fixed by the Appropriate Governments

-

Wages ceiling for calculation of Bonus : To be fixed by the Appropriate Governments

-

-

Contractor’s payment shall be ensured by Company before the contractor makes the payment of wages to his employees (Rule 54)

-

In case of non-payment of minimum bonus to the contract worker, company should pay the same. But no specification about recovery from contractor - Rule 56

-

The appropriate government shall fix ( Sec 13 )

-

the hours of work which constitutes a normal working day;

-

define the intervals in a working day;

-

provide for a rest day in every 7 days;

-

if the employee is called to work on a rest day or works beyond normal hours, then payment is to be made at overtime rates (i.e. twice the normal rate)

-

-

Central Rules (Draft) :

Daily hours shall be maximum of 9 hours (Rule 6) -

Spread over in normal circumstances 12 hours and in case of overtime shall not exceed 16 hours. (Rule 9)

-

Overtime shall be allowed or required, only in case of sudden spurt of business (Rule 9).

-

One day weekly holiday to be given after end of 6 working days. (Rule 7).

-

-

Employer shall fix the wage period and it shall not be more than one month ( Sec 16 ):

-

Daily wage shall be paid by the end of the day

-

Weekly wage shall be paid on the last working day of the week

-

Fortnightly wage shall be paid within 2 days after the end of the period

-

Monthly wages shall be paid within 7 days after the month

-

-

Minimum wage applies to employees as well as workers

-

The appropriate Governments can fix the rates of minimum wages

-

Definitions of Unskilled, Semiskilled, Skilled and Highly Skilled Occupations are introduced in the Rules [Rule 2 (j), (t) (u) & (v)]

-

Geographical Areas classified as metropolitan, non-metropolitan and rural areas (Rule 4)

-

‘Metropolitan’ means 40 lakhs and above population area - Rule 2(m)

-

‘Non-metropolitan’ means above 10 lakhs but below 40 lakhs - Rule 2(n)

-

‘Rural area’ means other than metro and non-metro - Rule 2(q).

-

-

Only authorized deductions are to be made ( Sec 18 )

-

Wage slip shall be issued

-

Total amount of deduction in any wage period from the wages of employed person shall not exceed 50% (Currently in case of co-operative Society – 75%)

-

Recovery of advance can be done without any stipulated time but with one condition ie. Recovery can't go more than 50% on any wage period (Rule 19). (Currently in TN – 12 months)

-

Deduction for damage or loss shall be done only with specified procedure. Explain personally and intimate in writing within 15 days from the date of such deduction (Rule 18)

-

Undisbursed due ( unpaid accumulation) period is 6 months - Rule 46

-

Amount to be settled within 15 days from the date of last day of due period. (Rule 46(1))

-

Amount to be deposited through bank transfer or DD - Rule 46 (2)

-

-

If the undisbursed amount remains unclaimed for a period of seven years, the same shall be dealt in the manner as directed by the Central Government - Rule 47(4)

-

Mode of payment of bonus - Only by giving bank credit

-

Disqualification for bonus : ‘conviction for sexual harassment’ added

-

Differentiates ‘employee’ (Sec 2(k)) and ‘worker’ ( Sec 2(z))

-

Sec 2(f) defines who ‘a contractor’ is ( almost on par with the one in the existing CLRA Act )

-

Period of limitation is 3 years for claim.

-

Claim to be determined and in addition 10 times of such amount (MW, Bonus & Equal Wages)

-

-

Introduction of Web based inspection Scheme

-

The role of inspector is modified as Inspector-cum-facilitator

-

-

Wages shall be paid in current coin or currency notes or by cheque or by crediting wages in the bank a/c ( Sec 15 )

-

In case of complaint, Court can take cognizance directly from employee and the Registered Trade Union

-

Burden of Proof - lies with the employer

-

Enhanced Penalties for offence with the view of priority to compliance:

-

For the offence of non-payment for the first time : Rs 50000/- fine

-

For the subsequent offence : Rs 100000/- fine or 3 months or both

-

38. For the offence of non-payment for the first time : Rs 50000/- fine

-

For the subsequent offence : Rs 100000/- fine or 3 months or both

-

For non-maintenance / improper maintenance of records : Rs 10000/-

-

For any other non-compliance for the first time : Rs 20000/- fine

-

For the subsequent offence : Rs 40000/- fine or 1 month or both

-

Note: Data sourcing from CII and Greyt HR - HR Conclave - July 2022

Code on Wages,2019

Bill passed in Lok Sabha (30th July 2019), Rajya Sabha (2nd August 2019) and Received President’s Assent on 8th August 2019, Draft Central Rules issued.